How to Secure Your Mobile Banking App Against Keyloggers

Mobile banking has become an essential part of daily life, offering convenience at our fingertips. With just a few taps, we can check balances, transfer money, and pay bills. However, this convenience also opens doors to cyber threats, particularly keyloggers. Keyloggers can secretly record sensitive information like passwords, making mobile banking security a top priority for both users and developers. Here’s an in-depth guide on how to secure your mobile banking app against these dangerous threats.

Minimalistic illustration focused on mobile banking app security

Recognizing Keylogger Threats

Keyloggers are malicious programs designed to record every keystroke on a device, capturing sensitive data such as login credentials, Personal Identification Numbers (PINs), and even private messages. They can infiltrate devices through various methods, including:

- Malicious apps or software downloads: Apps from untrusted sources may contain hidden keyloggers.

- Phishing emails and deceptive links: Clicking on suspicious links can install keyloggers without the user’s knowledge.

- Exploited security vulnerabilities in outdated apps: Old software often has security flaws that can be exploited by hackers.

Recognizing the signs of a keylogger infection is crucial for quick action. Be on the lookout for:

- Unusual device behavior: Unexpected crashes, freezing, or slow performance.

- Strange applications: Unfamiliar apps running in the background without your permission.

- Battery drain and data usage spikes: Keyloggers may consume extra resources, leading to faster battery drain and increased data usage.

Understanding these red flags can help detect potential threats early and minimize damage.

Tools to Secure Mobile Apps

To enhance mobile banking security, both developers and users need to adopt strong security tools and practices. Here are some effective methods:

- Encryption: End-to-end encryption ensures that data is scrambled during transmission, making it unreadable to unauthorized parties, even if intercepted.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security beyond passwords. It can involve SMS codes, biometric verification (like fingerprints or facial recognition), or authentication apps.

- Secure Code Practices: Regularly updating and auditing app code helps identify and fix vulnerabilities that keyloggers might exploit. Developers should also use secure coding frameworks to minimize risks.

- Anti-Malware Solutions: Reliable security software can detect and block keyloggers before they compromise the device. Keeping anti-malware tools updated is equally important.

- App Permissions Management: Restrict app permissions to only what is necessary. Avoid granting apps access to sensitive data unless absolutely required.

- Secure App Architecture: Implementing secure APIs, data storage practices, and sandboxing can limit the impact of a potential breach.

- Regular Security Testing: Conducting penetration tests and vulnerability assessments helps identify security gaps before attackers can exploit them.

- Biometric Authentication Advancements: The use of biometric authentication, such as fingerprint scanning and facial recognition, is becoming more prevalent in mobile banking apps. Future developments may incorporate AI-driven biometric security and multi-factor biometric authentication to enhance fraud detection and prevent unauthorized access.

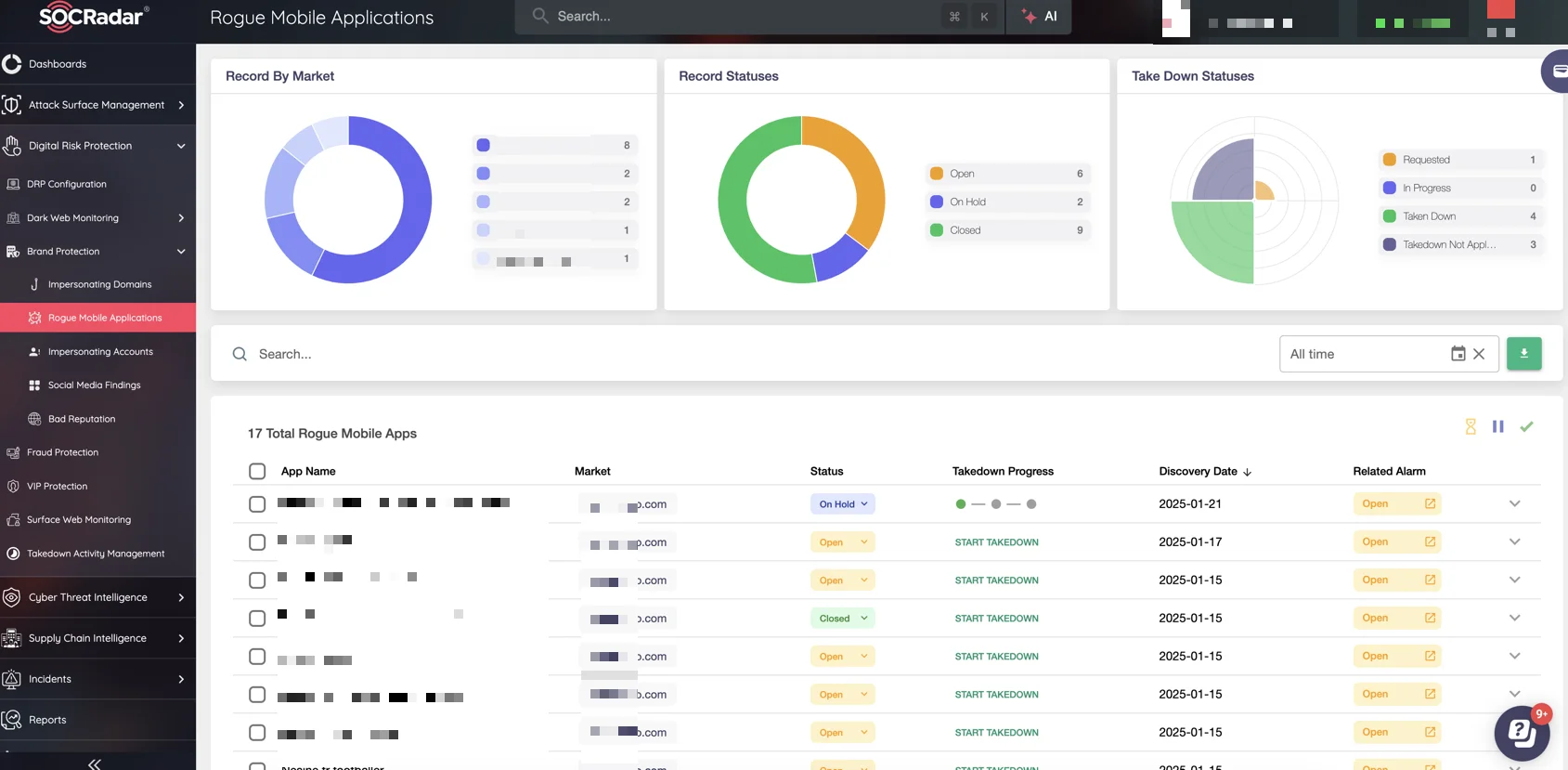

Consider, for example, the risk of rogue mobile applications that mimic legitimate apps to trick users and steal sensitive data. Organizations often struggle to detect these threats before they cause harm. This is where comprehensive solutions like SOCRadar Brand Protection‘s Mobile App Security (MAS) module can play a critical role. It helps identify malicious apps in app stores by analyzing APK codes, providing instant alerts on unusual app behavior, and offering insights into potential threats within your app ecosystem. This proactive approach allows organizations to detect and neutralize threats early, maintaining the integrity of their mobile apps without having to rely solely on reactive measures.

SOCRadar Rogue Mobile Applications module

Educating Users About Keyloggers

User awareness is a critical component of mobile banking security. Even the most secure app can be vulnerable if users are unaware of basic security practices. Here are key points to educate users:

Cybersecurity Best Practices for Mobile Banking App Security

- Download Apps from Trusted Sources: Encourage users to install apps only from official app stores like Google Play or the Apple App Store. These platforms have security checks to reduce the risk of malware.

- Avoid Clicking Suspicious Links: Teach users to recognize phishing attempts in emails, texts, or pop-ups. If something looks suspicious, it probably is.

- Regular Software Updates: Remind users to keep their devices and apps updated. Updates often include security patches that fix vulnerabilities hackers might exploit.

- Use Strong, Unique Passwords: Promote the use of complex passwords that combine letters, numbers, and symbols. Password managers can help generate and store strong passwords securely.

- Monitor Account Activity: Advise users to regularly check their banking activity for unauthorized transactions. Setting up account alerts for suspicious activities can provide an extra layer of protection.

- Enable Security Features: Encourage users to enable built-in security features like biometric locks, device encryption, and secure browsing modes.

- Avoid Public Wi-Fi for Banking: Public Wi-Fi networks are often unsecured, making them prime targets for cybercriminals. Recommend using a VPN when accessing sensitive information on public networks.

Conclusion

Securing mobile banking apps against keyloggers requires a combination of advanced security measures, proactive development practices, and continuous user education. By recognizing threats early, implementing robust security tools, and promoting safe user behaviors, financial institutions and individuals can significantly enhance mobile banking security. Protecting sensitive information from cyber threats isn’t just a technical challenge—it’s an ongoing process that involves everyone, from app developers to end-users. Stay informed, stay updated, and stay secure.