Top 5 Threats to Mobile Banking Security and How to Avoid Them

Mobile banking has become essential for convenient financial management in the digital age. However, this convenience also brings the risk of cyberattacks. As mobile banking grows, it is crucial to be aware of these threats and implement appropriate security measures. This article will discuss the top 5 threats to mobile banking security and how your organization can take action to mitigate them.

1. Mobile Trojans in E-Commerce

Convenient financial management in the digital era depends on mobile banking being absolutely necessary. This convenience, meantime, also carries the possibility of cyberattacks. Growing mobile banking calls for knowledge of these risks and application of suitable security mechanisms.

Advanced malware meant to target mobile banking apps is called mobile banking trojans. Usually disguising themselves as normal apps like file managers or utility utilities, these rogue programs could request rights allowing them to pilfers of sensitive data including card details and login passwords. Once set up, they can get SMS confirmation codes to allow illegal purchases through.

Techniques for Mitigation:

- Tool Binding: Ensures that a user’s account is linked to a specific device, preventing trojans from remotely accessing or modifying user data.

- Regular Security Updates: Keeping your mobile operating system and banking application up to date helps protect against known vulnerabilities.

- Cyber Threat Intelligence: Utilizing a Cyber Threat Intelligence tool helps stay informed about emerging threats and potential weaknesses in your online profile.

2. Attacks Based on Phishing

In digital banking, phishing attacks – where criminals pose as reputable companies using emails, SMS, or bogus websites to fool consumers into disclosing private information – are a regular hazard. These even more sophisticated strikes can be quite convincing.

Techniques for Mitigation:

- Show buyers how to identify phishing attempts.

- Install robust email monitoring and filtering tools to identify phishing emails one.

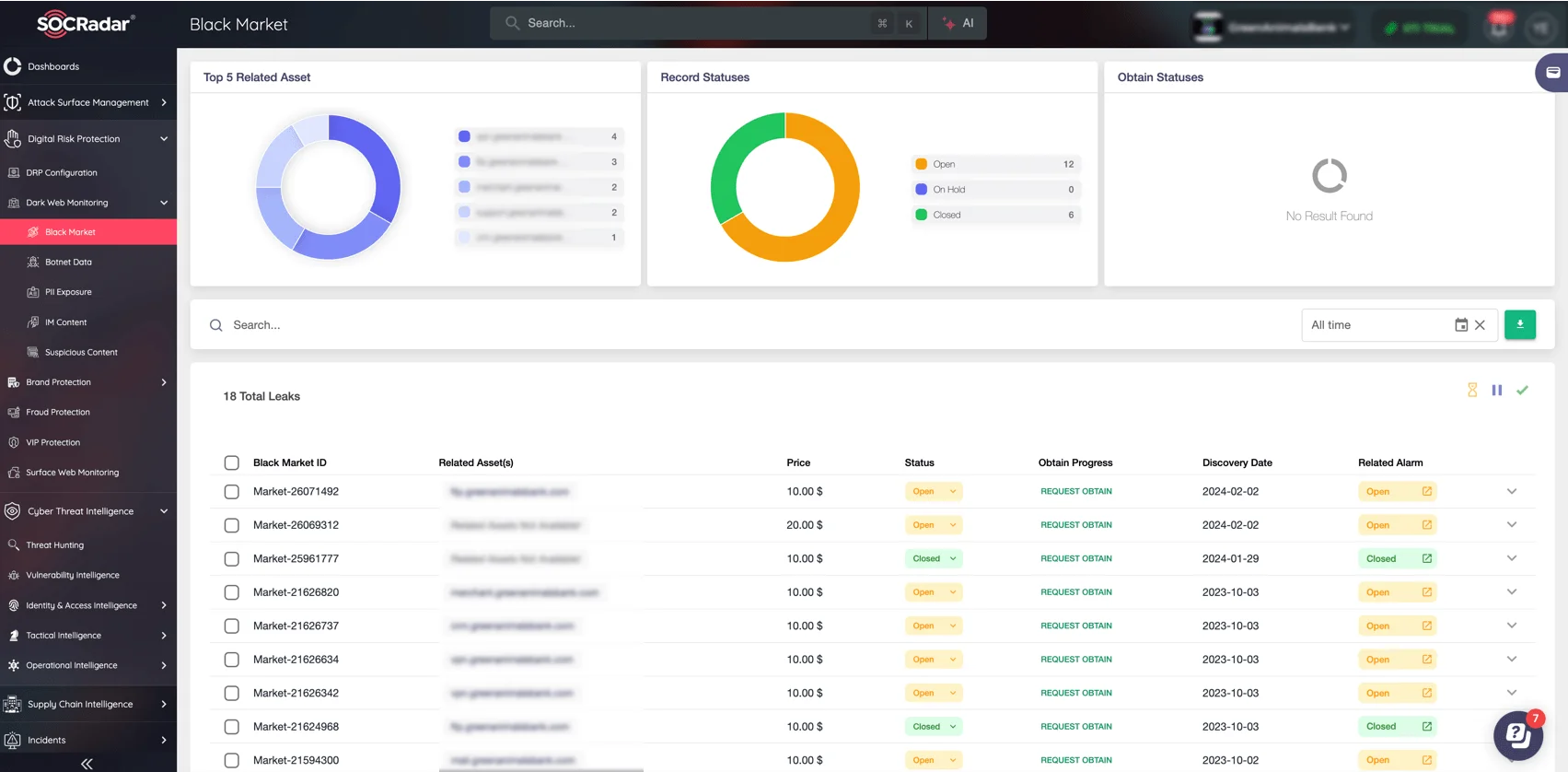

- Search for phishing kits and stolen credentials on the Dark Web with SOCRadar’s Dark Web Monitoring, therefore enabling preemptive responses against phishing threats.

3. Fake Banking Apps

Designed to pilfer credit card and financial data, phoney apps look to be legitimate banking apps. These schemes take advantage of consumers’ carelessness and can be distributed via illegal means.

Techniques for Mitigation:

- Download banking apps always from official sources like Apple App Store 4 or Google Play Store.

- Track phoney apps disguising themselves as authentic ones using the Mobile App Security (MAS) module of SOCRadar, therefore guaranteeing early discovery and avoidance.

4. Public Wi-Fi Dangers & Man-in-the-Middle (MITM) Attacks

Usually running over public Wi-Fi networks, MitM attacks include intercepting messages between a user and a banking app. This allows hackers to capture confidential data or inject malware.

Techniques for Mitigation:

- Use a secure, private network or mobile data instead of public Wi-Fi for banking activities.

- End-to-end encryption helps the banking app protect data in transit.

5. Synthetic Identity Theft

Though more common in digital banking, synthetic identity theft can compromise mobile banking by creating phoney identities for financial product application. This deception is hard to see since it combines real and false information.

Techniques for Mitigation:

- Among other advanced verification methods, apply robust biometric security and multi-factor authentication to prevent unauthorized access.

- Track for growing threats and stay current on any weaknesses in your digital footprint using Extended Threat Intelligence from SOCRadar.

Conclusion

Users and banks both have responsibilities for mobile banking security. The danger of cyberattacks can be much lowered by knowing the main hazards and putting sensible mitigating measures into use. By offering proactive threat detection and management solutions, SOCRadar’s creative tools – including the MAS module and Dark Web Monitoring – help to greatly improve mobile banking security.

Also, some tips for better security:

- Update apps routinely. Update all of your apps to guarantee you receive the most recent security fixes.

- Write strong passwords. For all of your accounts, choose unique and strong passwords; think about using a password manager.

- Turn on biometric security here: Add even more protection by using biometric authentication – fingerprints or face recognition.