Behind the Booking: Money Laundering and Scamming in the Sharing Economy

The sharing economy refers to a market where individuals can exchange goods and services directly, often facilitated by online platforms. In this model, assets such as homes, vehicles, or skills are shared or rented out by individuals to others on a short-term basis. Companies like Airbnb and Uber are prime examples, where people rent out spare rooms or offer ride-sharing services, bypassing traditional service providers.

The rise of the sharing economy has transformed industries and consumer behavior, offering convenience and accessibility. However, with this growth comes an increasing vulnerability to exploitation by criminal networks. Among the most concerning risks is the use of these platforms for money laundering activities.

Money laundering through these platforms presents a unique challenge due to the largely autonomous nature of these applications. Use of cryptocurrencies also adds another layer of complexity to the existing challenges. Criminals exploit the gaps in oversight, leveraging services such as short-term property rentals and ride-sharing to facilitate financial crimes.

This article examines the methods used by threat actors to launder money through Airbnb, Uber, and similar platforms, identifies the associated risks, and provides actionable recommendations for users.

Common Scams in AirBnB and Uber

Threat actors are driven by several key motivations when they try to engage in money laundering schemes within the sharing economy, often centered around concealing illicit gains and minimizing the risk of detection.

Generated by ImageFX

The primary motivation for most money launderers is obviously to obscure the origin of illegally obtained funds. Criminal activities like drug trafficking, fraud and cybercrime generate large sums of money that must be “cleaned” to avoid detection by authorities. The sharing economy offers a relatively low-profile way to funnel these funds through seemingly legitimate transactions.

Many sharing economy platforms offer certain levels of user anonymity. Additionally, even though the transfer of funds still occurs between banks; these platforms provide a layer of obscurity that threat actors can benefit from. This structure appeals to criminals who wish to mask their identities while carrying out financial operations, making detection more difficult for authorities.

On top of the user anonymity, the vast scale of platforms like Airbnb and Uber, with millions of daily transactions, allows criminals to blend in their illicit activities among legitimate users. The sheer volume of bookings and ride-sharing requests helps conceal individual money laundering efforts.

Types of scams targeting users and businesses

When it comes to scams related to sharing economy platforms, two main themes emerge: fake listings or services targeting unsuspecting individuals, and money laundering schemes.

Scammers are increasingly exploiting platforms like Airbnb by creating fraudulent property listings that utilize images and descriptions of legitimate properties, yet lack any genuine intention to deliver the advertised service.

Users who book these properties often pay in advance, only to find upon arrival that the listing is either non-existent or unavailable. While these fraudulent schemes may occur only one time and can sometimes be mitigated by these platforms’ algorithms, they can still have impact on individuals.

Another thing threat actors do is to create fraudulent listings or ride-share profiles to facilitate the laundering of illicit funds. By generating fake bookings or rides, they can effectively disguise illegal earnings as legitimate income.

Airbnb hosts participate in these schemes by either posting or responding to advertisements on dark web forums. Instead of actually hosting guests, they receive money from guests who never arrive. Once the transaction is complete, the host gives a portion of the money to the threat actor orchestrating the scheme.

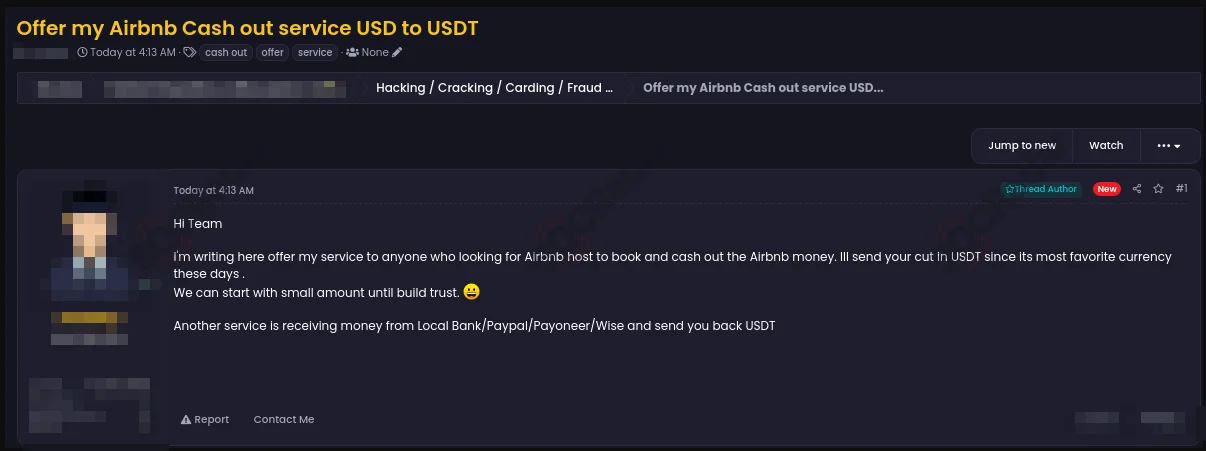

A Dark Web forum monitored by SOCRadar

In a dark web forum monitored by SOCRadar, a threat actor has allegedly advertised a new Airbnb-based cash-out service. The individual claims to facilitate money laundering through the platform by offering to “book and cash out” funds on behalf of users.

The alleged service includes receiving payments from local banks, PayPal, Payoneer, or Wise and converting them into USDT for customers.

Such activities, often associated with underground financial operations, highlight the critical need for monitoring these threat actors and taking the necessary steps before they try to commit fraud.

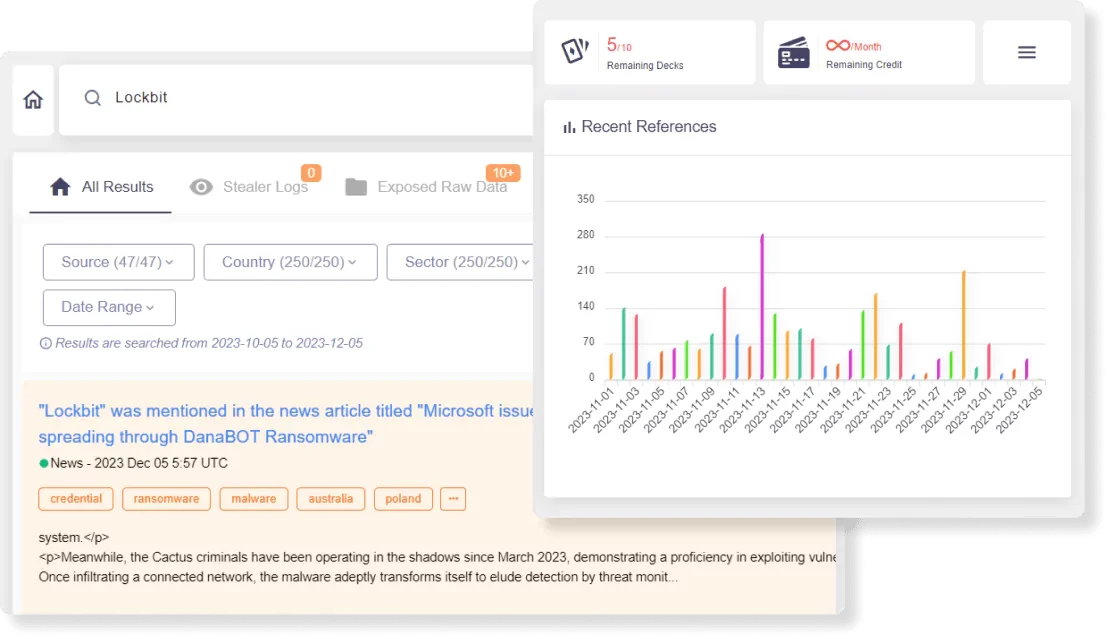

Advanced Dark Web Monitoring is vital to your organization’s cybersecurity infrastructure, providing a comprehensive overview of potential risks in the dark web ecosystem. This feature offers real-time monitoring capabilities, tracking Personal Identifiable Information (PII) exposures, and identifying threat actors and malicious activities.

You can track stealer logs, detect PII exposures or monitor underground forums with SOCRadar’s Advanced Dark Web Monitoring module.

SOCRadar Advanced Dark Web Monitoring

Recommendations

- Regularly review your transaction history to ensure no unauthorized or suspicious activities, such as unexpected bookings or charges, have occurred.

- Avoid booking properties or rides that are priced significantly lower or higher than the average, as this could indicate an attempt to launder money.

- Conduct all communication with hosts or drivers through official platforms. Avoid off-platform payments or private communication, as these will be preferred by threat actors since they are not monitored.

- If you notice anything out of the ordinary, such as fake listings, repeated bookings at odd hours, or hosts/drivers insisting on cash payments, report it immediately to the platform.

- Always check reviews and ratings for hosts or drivers. Fake accounts or those involved in laundering activities might have unusually high ratings but with vague reviews, or they may show signs of a lack of legitimate customer feedback.

- Enable 2FA for your accounts to prevent unauthorized access and protect your data and finances.

Conclusion

The sharing economy has fundamentally reshaped the way goods and services are exchanged, fostering convenience and opportunity across industries. However, its rapid growth and decentralized nature have also made it a target for exploitation by criminals, particularly in the realm of money laundering. Platforms like Airbnb and Uber, designed for seamless peer-to-peer transactions, can inadvertently serve as conduits for illicit financial activities.

As the sharing economy continues to evolve, so too will the methods employed by those seeking to abuse it. Ongoing collaboration between businesses, financial institutions, and regulatory bodies will be key in ensuring that these platforms remain safe and trustworthy, preserving their innovative benefits while minimizing their appeal to criminal actors.