Cyber Insurance and Protecting Against Security Breaches

With the rise of digital threats, cyber insurance has become an important part of risk management for businesses of all sizes. As cyberattacks such as data breaches, ransomware, and system compromises become more sophisticated, businesses are increasingly turning to cyber insurance to mitigate the financial impact of these incidents. This article delves into the fundamentals of cyber insurance coverage, including exclusions and current market trends.

What is Cyber Insurance?

Cyber insurance, also known as cyber liability insurance, is a specialized policy that protects businesses against the financial consequences of cyber-related incidents. These incidents can range from malicious attacks such as ransomware and data breaches to cyber-related business disruptions. As companies become more reliant on digital systems and store more sensitive data, the risk of cyberattacks increases, necessitating the use of cyber insurance as a risk mitigation tool.

An AI illustration of cyber insurance

Legal fees, data restoration, notification of affected parties, and even public relations efforts to restore a company’s reputation are all typical costs covered by cyber insurance policies. The financial support provided by cyber insurance enables businesses to navigate the costly aftermath of a breach while minimizing operational disruptions.

What Does Cyber Insurance Cover?

Cyber insurance covers a wide range of expenses caused by cyberattacks and breaches. These typically include:

- Data Breach Costs: Coverage includes expenses for investigating a breach, notifying impacted customers, and offering credit monitoring services. Public relations costs to manage reputation damage may also be included.

- Legal Fees: Cyber insurance can cover legal expenses incurred from defending lawsuits related to a data breach or non-compliance with regulations like GDPR or HIPAA.

- Ransomware Payments: If a business is targeted by ransomware, the policy may cover ransom payments and the cost of negotiations with cybercriminals, you can check our blog to know more about Cyber Insurance in the Age of Ransomware.

- Business Interruption: If a cyberattack disrupts business operations, the policy can compensate for lost income during downtime.

- Data Recovery and Restoration: The policy typically covers the cost of recovering and restoring lost or compromised data following an attack.

- Third-Party Liability: If a breach impacts customers or vendors, cyber insurance may cover damages and legal claims related to the incident.

While these elements are the foundation of most cyber insurance policies, it’s important to note that coverage varies by insurer, and many require businesses to meet stringent cybersecurity standards before receiving comprehensive coverage. To be eligible for the best terms, companies must implement safeguards such as data encryption, Multi-Factor Authentication (MFA), and regular risk assessments.

What Does Cyber Insurance Not Cover?

While cyber insurance is useful for protecting against many cyber-related risks, it does not typically cover all of them. Understanding these exclusions is critical for ensuring that your business is fully protected. Here are some common areas where it can fall short:

- Pre-Existing Vulnerabilities: Cyber insurance does not typically cover incidents caused by known vulnerabilities that an organization failed to address prior to the policy’s effective date. If your systems are outdated or not properly maintained, any breach caused by these flaws may not be covered.

- Intentional Acts by Insiders: Cyber insurance typically excludes coverage for security incidents caused by malicious or intentional actions by an organization’s employees or contractors. While insider threats are a major concern, companies may need to address them through additional policies or security protocols.

- Loss of Future Profits: While the insurance may cover business interruption caused by a breach, it does not typically cover long-term losses, such as a drop in profits or future earnings as a result of reputational damage following the incident.

- Fines and Penalties Due to Non-Compliance: Some cyber insurance policies may cover fines for regulatory violations (such as GDPR), but many do not. If your company is found to be noncompliant with regulations due to negligence, the policy may waive these penalties.

- Reputation Damage: While public relations efforts may be covered to mitigate reputational damage, it typically exclude coverage for actual loss of reputation or brand value as a result of a breach.

- Stolen Intellectual Property: Cyber insurance does not typically cover the loss of intellectual property (IP) or the potential loss of competitive advantage caused by stolen trade secrets or proprietary information.

Cyber Insurance in 2023: A Market on the Rise

According to the “2024 Cyber Insurance Market Conditions Outlook” report, the global cyber insurance market exceeded $10 billion in premiums in 2023, indicating an increasing demand for protection against the growing threat of cyberattacks. This growth was primarily driven by a 95% increase in ransomware activity over the previous year. The ransomware ecosystem has evolved, with criminal groups rebranding and using more sophisticated tactics such as double extortion, which encrypts and exfiltrates data. This increase in attack severity contributed to an increase in the frequency of cyber claims, particularly in industries such as healthcare, financial services, and technology, where the average cost of a data breach has reached a new high of $4.35 million.

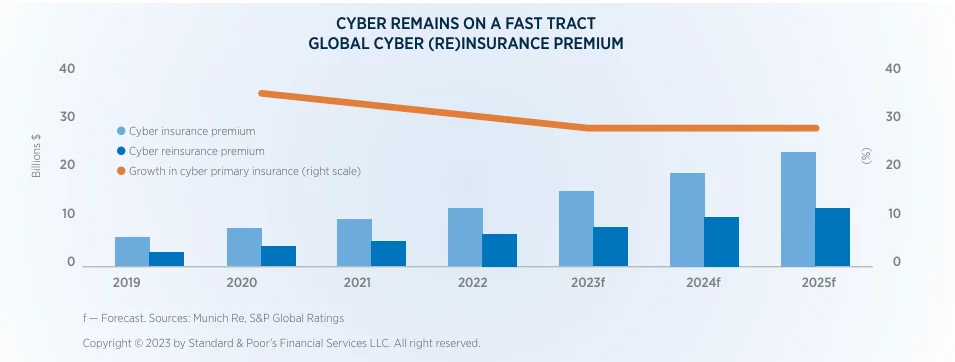

Insurance premiums growth within the years as depicted on the report

Additionally, increased regulatory risks are influencing the cyber insurance landscape. Businesses must comply with cybersecurity regulations under stricter conditions as a result of new privacy laws and increased scrutiny from bodies such as the Securities and Exchange Commission (SEC). These trends are resulting in higher premiums and coverage adjustments. Reinsurance markets are also rapidly expanding, with reinsurers issuing catastrophe bonds to cover major cyber events. The market is expected to double every three years as organizations and insurers adapt to the evolving threat landscape.

Affirmative vs. Non-Affirmative Coverage

One of the more complicated aspects of cyber insurance is the distinction between affirmative and non-affirmative (silent) coverage. Affirmative coverage explicitly defines which cyber risks are covered, whereas non-affirmative policies are frequently ambiguous, leading to confusion about what is actually covered in the event of a cyber incident. This lack of clarity may expose businesses to significant risks.

Insurers are increasingly attempting to address this issue by changing policy language to eliminate uncertainty. However, it is still critical for organizations to fully understand the terms of their cyber insurance policies and the scope of coverage they provide.

Regulatory Impact and Cybersecurity Standards

To obtain comprehensive coverage, businesses are frequently required to meet a number of cybersecurity standards. Many insurers now require companies to implement strong cyber hygiene practices, such as multi-factor authentication, encryption, and regular security audits, before providing full coverage. In fact, insurers have become more selective, denying coverage to businesses that do not meet these standards, potentially increasing costs for high-risk industries or inadequately protected organizations.

To help businesses meet these standards and stay ahead of evolving cyber threats, SOCRadar offers a suite of advanced cybersecurity solutions:

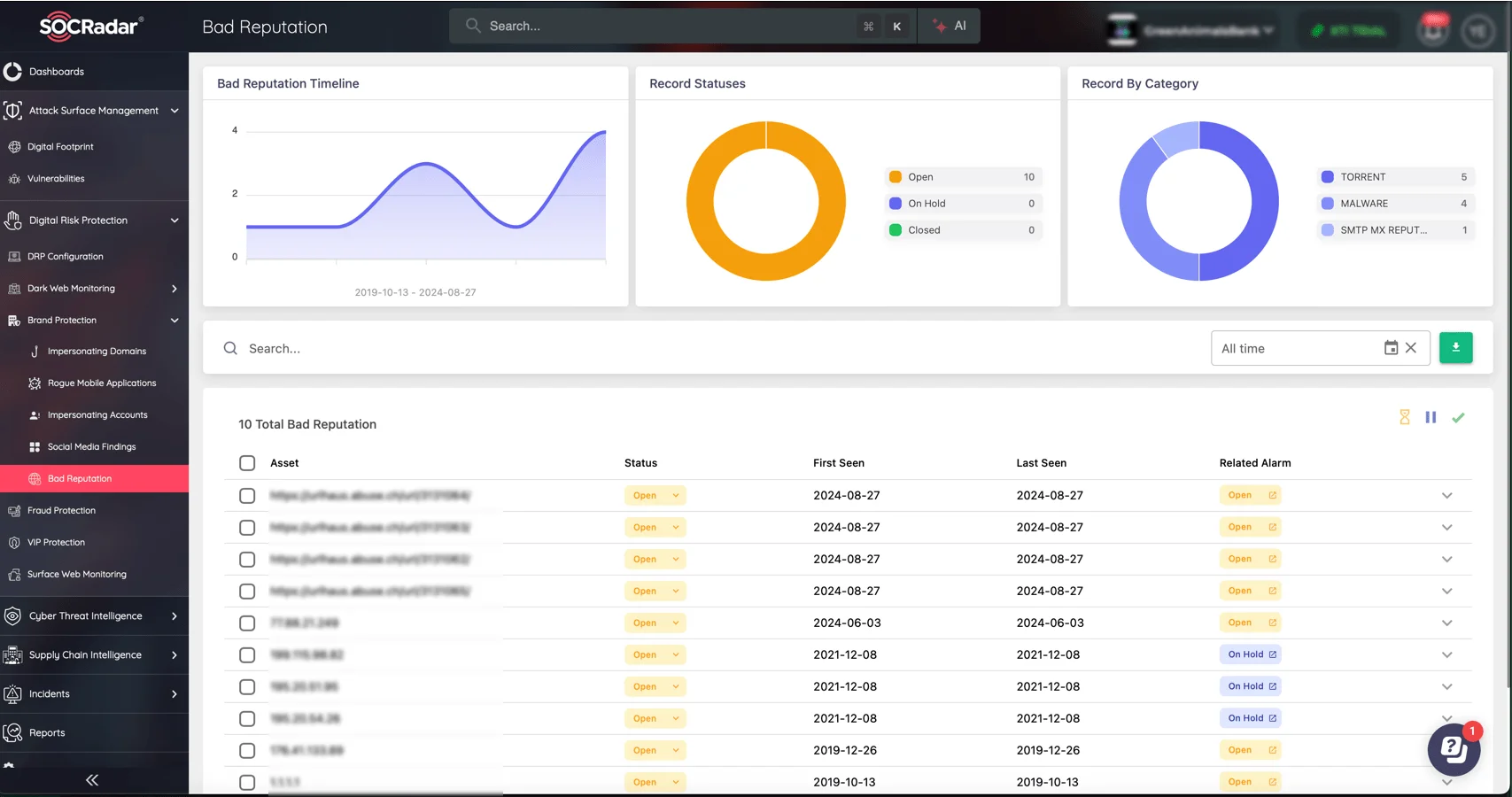

- Brand Protection: SOCRadar’s Brand Protection Services keep organizations one step ahead of threat actors by constantly monitoring the surface and dark web for brand misuse, unauthorized exposure of sensitive data, and phishing attempts. With real-time alerts and actionable intelligence, you can protect your brand from reputational damage, legal issues, and other cyber threats.

SOCRadar’s Brand Protection module

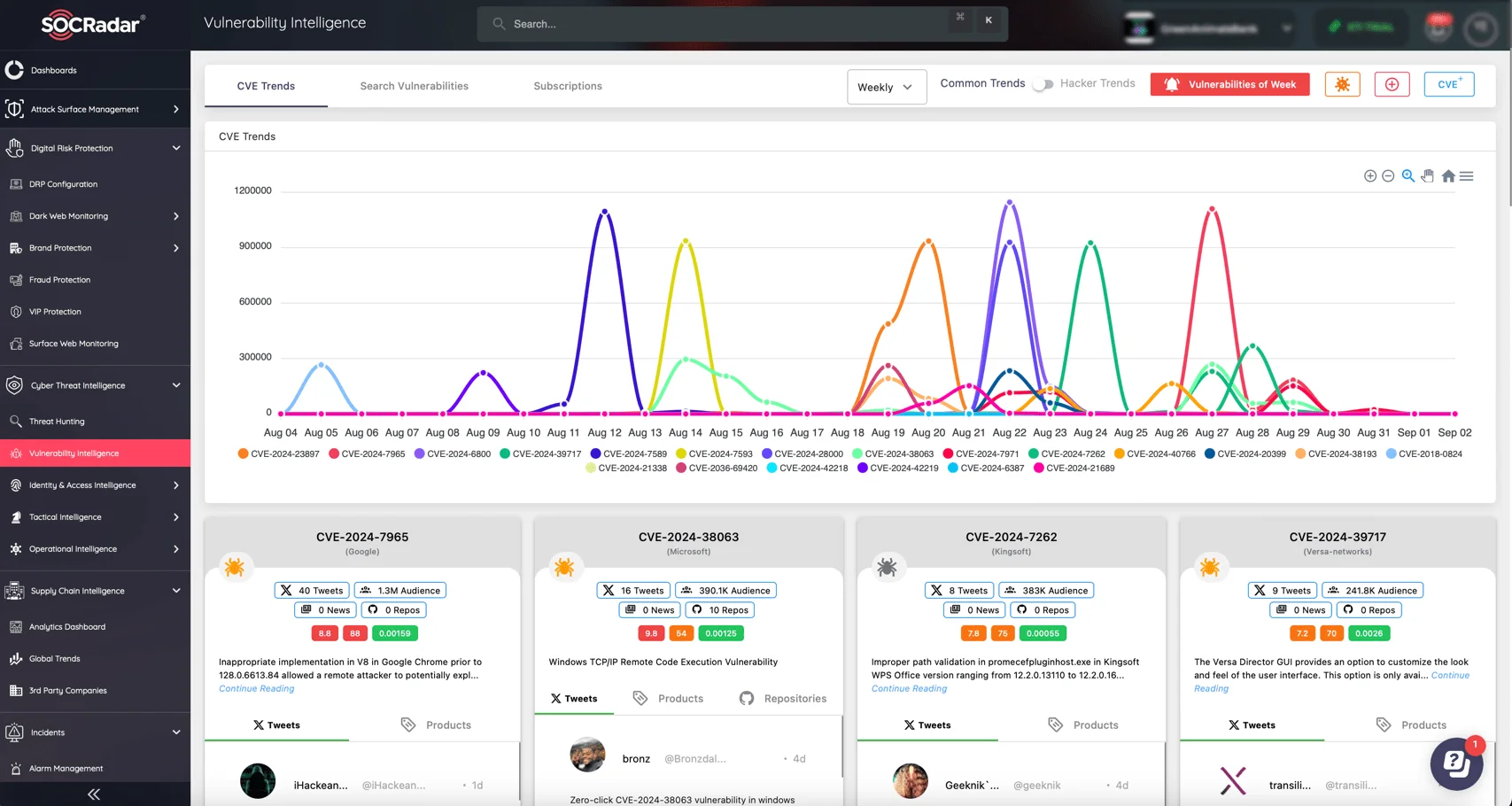

- Vulnerability Intelligence: SOCRadar’s Vulnerability Intelligence enables businesses to proactively defend against emerging vulnerabilities by providing advanced alerts and actionable insights into critical vulnerabilities. It monitors public-facing services and technologies, allowing organizations to respond quickly to potential threats and avoid disruptive breaches. SOCRadar provides instant alerts about exploited vulnerabilities, allowing you to adjust your security measures quickly.

SOCRadar’s Vulnerability Intelligence module

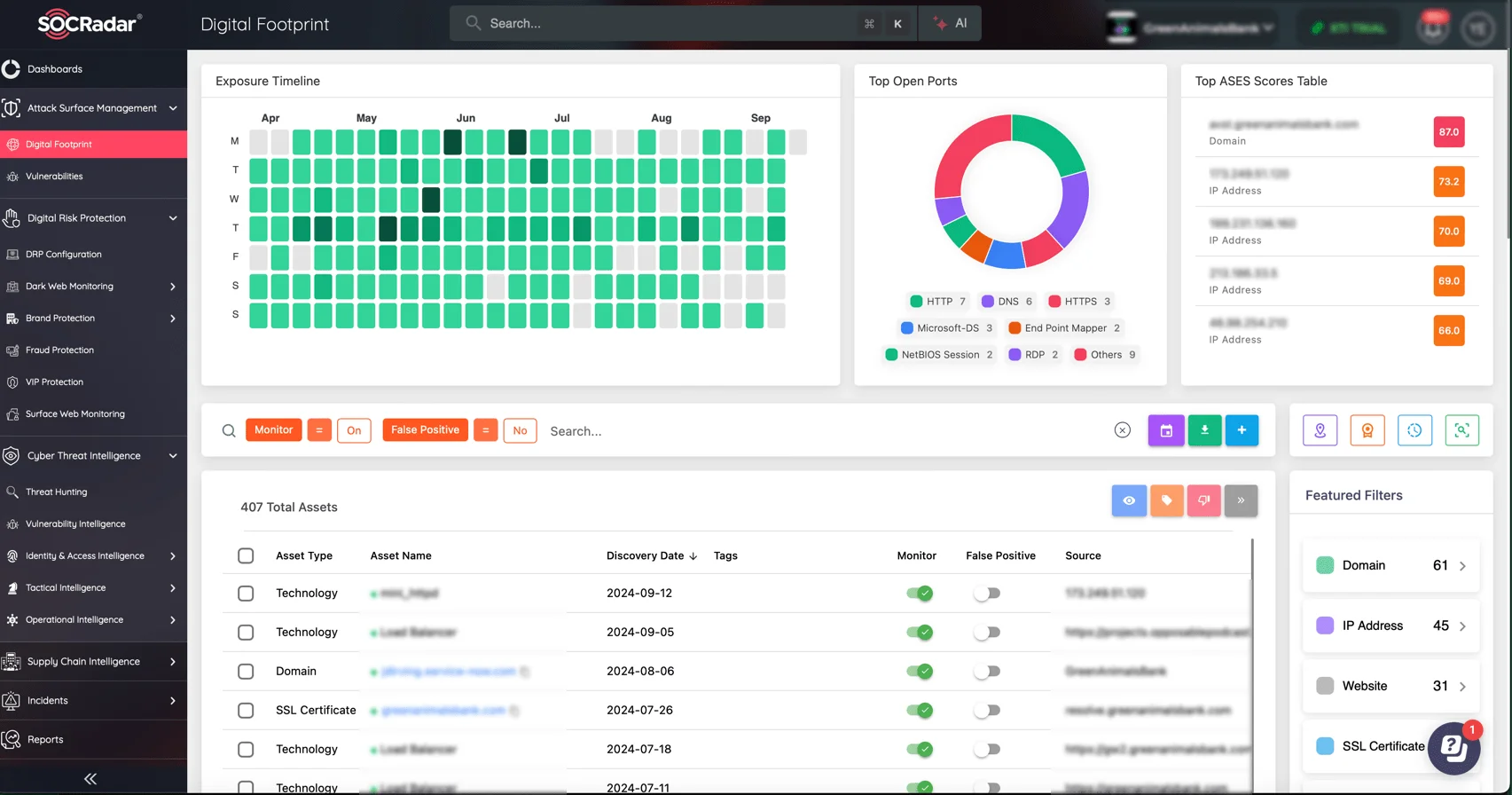

- Attack Surface Management: SOCRadar’s Attack Surface Management gives businesses complete visibility into their expanding digital attack surface. SOCRadar detects problems such as expired SSL certificates, exposed sensitive information, and undiscovered cloud assets by constantly monitoring your organization’s digital assets in real time. This proactive approach ensures that your company is prepared to combat cyber threats before they cause damage.

Digital Footprint in SOCRadar’s Attack Surface Management module

Conclusion

Cyber insurance plays a vital role in managing the financial risks associated with cyber threats. While it offers valuable coverage for many aspects of cyber incidents, businesses must also be aware of the limitations and exclusions in their policies. As the cyber threat landscape continues to evolve, the demand for cyber insurance will likely increase, particularly as insurers continue to tighten their standards and the cyber protection gap for smaller enterprises widens. Businesses should view it as one part of a broader cybersecurity strategy, complementing strong internal security practices and compliance with industry regulations.