Dark Web Market: BidenCash

Dark web markets have become a thriving hub for cybercriminals, trading stolen data, compromised credentials, and illicit tools. Among these, BidenCash has emerged as a significant player since its debut in 2022. Unlike legitimate marketplaces, platforms like BidenCash specialize in enabling cybercrime on a global scale, offering a wide array of stolen information to meet the demands of the underground economy.

The impact of such markets is alarming. Global credit card fraud losses are projected to reach $43 billion by 2026, up from $34 billion in 2022, according to Merchant Cost Consulting. Furthermore, studies indicate that up to 80% of all credit cards in circulation have already been compromised through hacks or data breaches. These statistics underscore the dangers posed by dark web markets.

Through aggressive promotional campaigns and an ever-expanding range of services, BidenCash has made cybercrime more accessible, even for inexperienced actors. Its operations leave individuals and organizations vulnerable, intensifying the need for robust cybersecurity measures to combat these growing threats.

What is BidenCash Market?

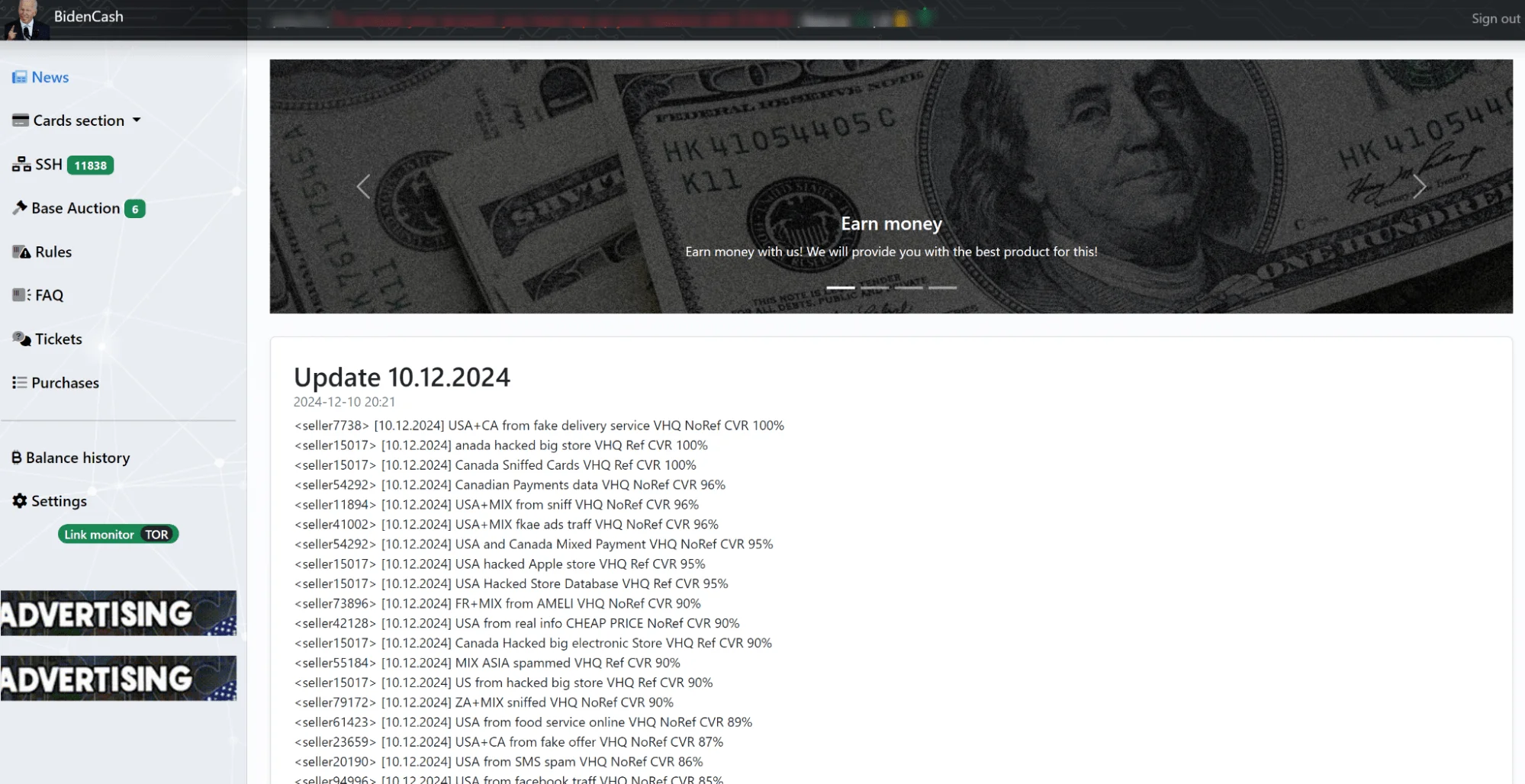

BidenCash is a dark web marketplace established in 2022, specializing in the trade of stolen credit card information, Personally Identifiable Information (PII), and Secure Shell Protocol (SSH) credentials. The platform is designed to cater to cybercriminals, offering a wide array of services and tools for both buyers and suppliers.

Positioning itself as a sophisticated and user-friendly marketplace, it provides an intuitive interface, secure payment systems, and advanced features such as buyer protection and loyalty programs. The marketplace operates across both the dark web and clearnet.

Home page of BidenCash

BidenCash gained notoriety through its frequent promotional data dumps, where it releases vast quantities of stolen data for free to attract users and demonstrate the scale of its inventory. Over time, it has evolved to include the sale of SSH credentials, enabling cybercriminals to access compromised servers for malicious purposes, further expanding its impact on the cybercrime landscape.

By combining innovative features with a vast supply of stolen data, it has quickly become a key player in the underground economy, posing significant challenges to individuals and organizations worldwide.

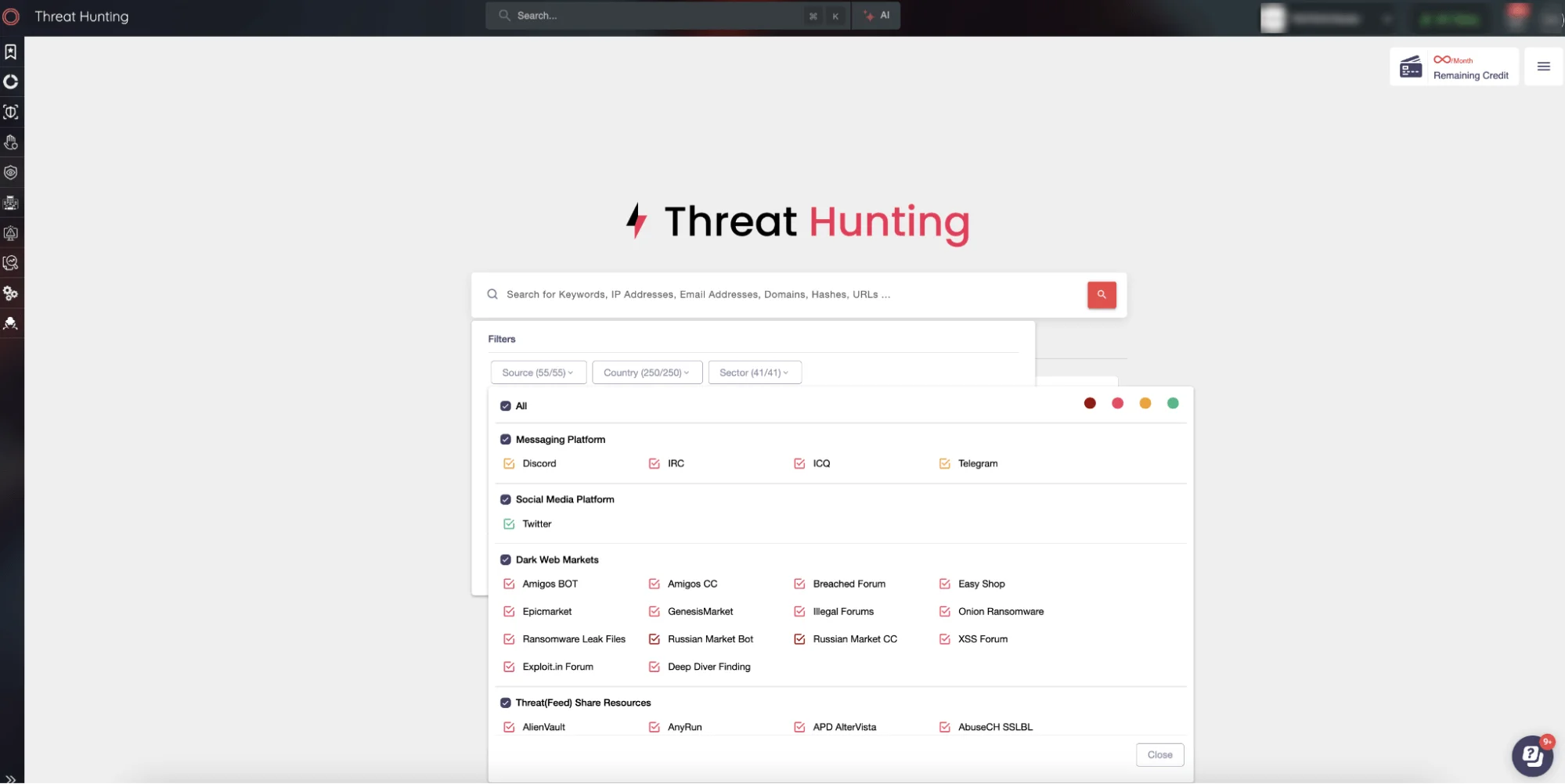

Marketplaces like BidenCash have transformed the way cybercriminals trade stolen data, making it more accessible than ever. For organizations, this means the need for proactive defense strategies has never been greater. SOCRadar’s Threat Hunting module, integrated within its Cyber Threat Intelligence (CTI) capabilities, provides critical tools to stay ahead of these evolving threats.

SOCRadar Cyber Threat Intelligence Module, Threat Hunting

By leveraging SOCRadar’s advanced monitoring features, organizations can uncover whether their sensitive data or credentials are being sold on platforms like BidenCash. This visibility allows security teams to take immediate action, reducing the potential impact of breaches and ensuring a stronger security posture in the face of such threats.

BidenCash’s Features and Services

BidenCash operates as a malicious dark web marketplace designed to facilitate cybercriminal activities. The platform offers tools and services that cater to both buyers and suppliers of stolen data, making it a hub for illegal transactions and activities. Its interface is built for easy navigation, lowering the entry barrier for individuals engaging in cybercrime.

The platform includes features that enable the real-time removal of publicly available stolen data from its listings, ensuring exclusivity for its buyers. This system not only perpetuates illegal trade but also signals a deliberate effort to enhance the appeal of its stolen materials. Additionally, BidenCash automates purchases, allowing buyers to set parameters for recurring acquisitions, further streamlining the process of acquiring illicit goods.

Suppliers on BidenCash benefit from tools that facilitate the sale of stolen information, including detailed sales analytics and rapid payouts. These features incentivize suppliers to continually upload stolen data, fueling the marketplace’s operations. By integrating its API with other illegal marketplaces, BidenCash expands the reach of its offerings, encouraging widespread distribution of compromised information.

Through these features, BidenCash amplifies the scale and efficiency of cybercrime, making it a significant threat to organizations and individuals alike. Its role in the dark web ecosystem highlights the challenges posed by such platforms in combating digital fraud and theft.

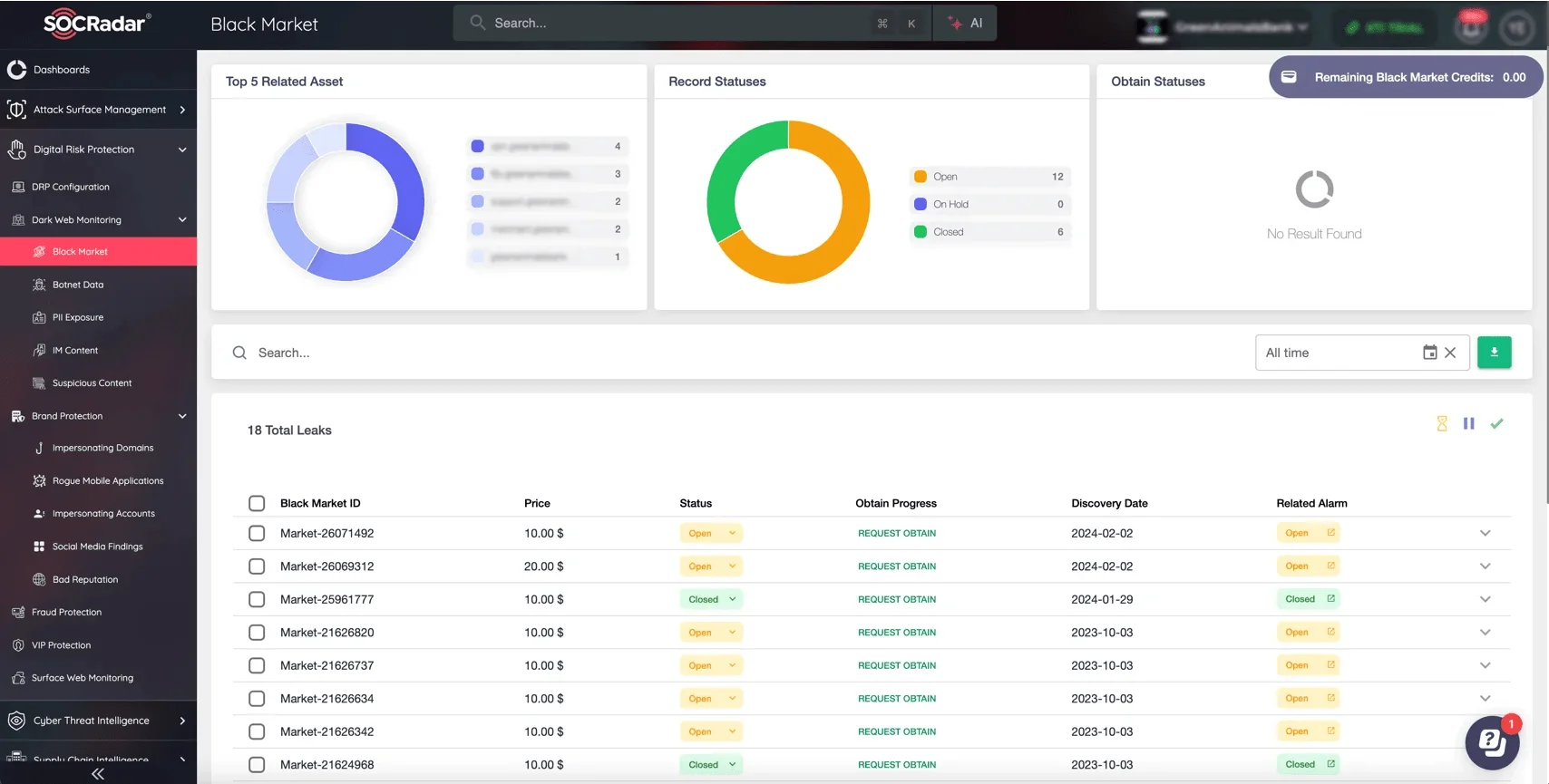

Proactive threat detection is essential in combating cybercrime. SOCRadar’s Dark Web Monitoring module dives deep into hidden online spaces, including dark web forums and marketplaces like BidenCash, to uncover potential threats to your organization. By scanning for compromised credentials, sensitive data, or malicious activity, it provides actionable insights to help safeguard your assets.

Monitor black market leaks, botnet data, PII exposure, and more with SOCRadar’s Dark Web Monitoring

With the ability to track black market leaks, PII exposure, and cybercriminal tools, SOCRadar ensures your security teams stay ahead of emerging threats. Advanced filters and real-time alerts enable swift identification of stolen data, helping you counter risks originating from platforms like BidenCash effectively.

Promotional Campaigns: The Role of Data Dumps in BidenCash’s Strategy

BidenCash’s reliance on promotional data dumps has been a cornerstone of its operations, helping the platform solidify its presence within the dark web community. These campaigns are crafted to both showcase its inventory and attract new buyers by offering stolen data for free, creating a powerful marketing tool for the marketplace.

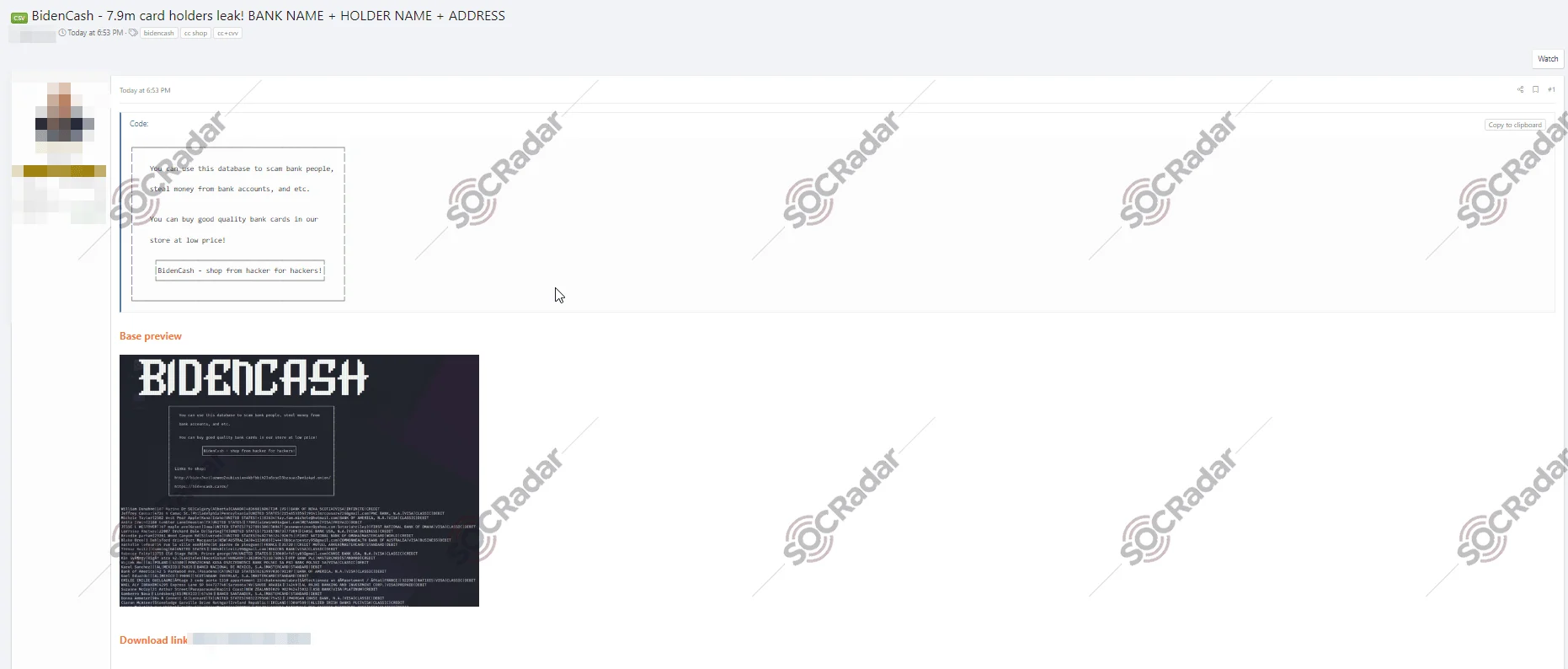

BidenCash’s June 2022 dump exposed details of 7.9 million cardholders, including bank names, holder names, and addresses

One such notable event occurred on June 16, 2022, when BidenCash released a massive dataset containing information on 7.9 million cardholders. The leaked data included sensitive details such as bank names, cardholder names, and addresses. This dump represented one of the largest promotional campaigns by BidenCash at the time, signaling its ability to access and distribute an unprecedented amount of stolen personal and financial information.

BidenCash dump download page

In October 2022, BidenCash carried out a major promotional campaign by leaking a dataset containing 1.2 million records. This operation served to bolster the platform’s credibility, demonstrating its ability to consistently access and distribute a significant volume of sensitive information.

On February 28, SOCRadar detected a post by BidenCash on a Russian-dominated hacker forum, leaking 2.1 million credit card details

The strategy escalated further in February 2023, with a dump of 2.1 million records. This marked an expansion of it’s inventory and underscored its growing influence in the dark web ecosystem. The timing and scale of this campaign were designed to reinforce the platform’s reputation as a reliable and prolific source of stolen data.

By May 2023, the market released another dataset containing 1.2 million records that included sensitive details such as CVV numbers, addresses, emails, and social security numbers. This leak highlighted the depth of the stolen data being traded and the platform’s focus on offering comprehensive identity packages, which are highly sought after in the cybercriminal community.

1.9 million credit card details exposed, highlighting advanced buyer protection claims

In December 2023, the SOCRadar Dark Web Team identified another significant data breach associated with BidenCash, where 1.9 million credit card details were leaked on a hacker forum. The exposed data contained card numbers, CVVs, and expiration dates. Alongside the breach, BidenCash emphasized a proprietary system it had implemented, claiming to offer “buyer protection” by ensuring the freshness of its data. This system is designed to monitor publicly available stolen data, penalize suppliers for stale materials, and maintain the exclusivity of its offerings.

These promotional efforts are not limited to merely advertising the platform’s capabilities. BidenCash also uses them as a method to promote its new domains or services, ensuring continuous engagement from its user base. For instance, following distributed denial-of-service (DDoS) attacks on its earlier domains, BidenCash leveraged such dumps to direct users to its newly established domains, maintaining its operational continuity.

By employing these campaigns, the market normalizes and incentivizes the use of stolen data, fueling the underground market and increasing the risks for individuals and organizations. The frequency and scale of these dumps underscore the platform’s commitment to expanding its reach and solidifying its dominance within the dark web ecosystem.

The Risks BidenCash Brings to Cybersecurity

The operations of BidenCash significantly impact global cybersecurity by enabling identity theft, financial fraud, and network breaches. Platforms like BidenCash not only support seasoned cybercriminals but also lower the barrier for inexperienced actors, allowing them to engage in illegal activities through its user-friendly interface and easily accessible stolen data. This broadens the scale and diversity of cyber threats.

By offering tools like SSH credentials and promoting buyer protection systems to ensure fresh data, BidenCash fuels a cycle of exploitation. These capabilities amplify the risks for individuals and businesses, as stolen credentials can lead to phishing attacks, ransomware deployments, and unauthorized system access.

A child in a dim room, buying stolen credit cards on a dark web site

The presence of such marketplaces underscores the need for robust cybersecurity measures, including continuous dark web monitoring, fraud detection systems, and secure access controls. BidenCash exemplifies how dark web platforms evolve to challenge defenses, making vigilance crucial to mitigating risks.

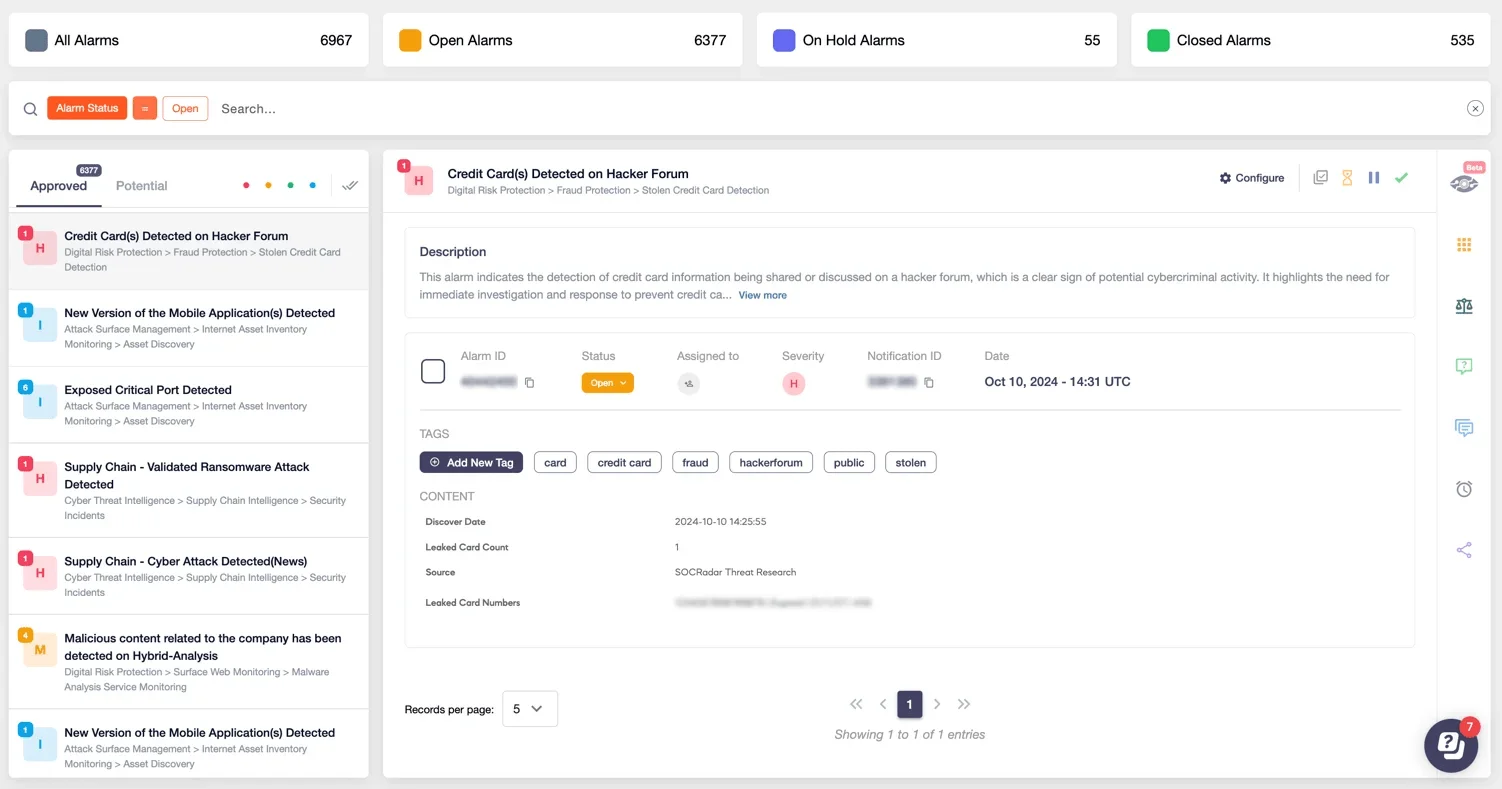

SOCRadar’s Extended Threat Intelligence (XTI) platform offers powerful tools to monitor and respond to threats related to credit card leaks on the Dark Web. By providing real-time alerts, the platform notifies security teams the moment stolen credit card details associated with their organization appear on hacker forums or dark marketplaces.

Alarm: Credit Card(s) Detected on Hacker Forum (SOCRadar Alarm Management)

With this proactive monitoring, organizations can quickly assess the extent of exposure and take immediate action to mitigate risks. SOCRadar’s XTI platform ensures that businesses stay one step ahead of cybercriminals, protecting both their assets and their customers from the fallout of credit card breaches.