Safeguarding Your Business: The Importance of Fraud Protection

In the past, banks employed various methods to protect their customers’ money. They installed heavy-duty vaults made of steel and iron to securely store money, gold, and other valuables, hired armed security personnel to guard the premises and prevent robberies, used reinforced doors and metal bars on windows, and, as technology progressed, started using mechanical alarm systems. But what about now?

Financial data encompasses a wide range of information, including personal and sensitive details such as bank account numbers, credit card information, social security numbers, and transaction records. Data protection for financial data is not just a matter of good practice; it is also mandated by various regulatory frameworks. Governments and regulatory bodies have established guidelines and laws to ensure the security and privacy of financial information. With cyber threats becoming increasingly sophisticated, the need to safeguard financial data has never been more crucial. In this blog, we explore the critical features and benefits of SOCRadar’s Fraud Protection, emphasizing its role as a frontline defense against financial data breaches.

Frontline Defense Against Financial Data Breaches

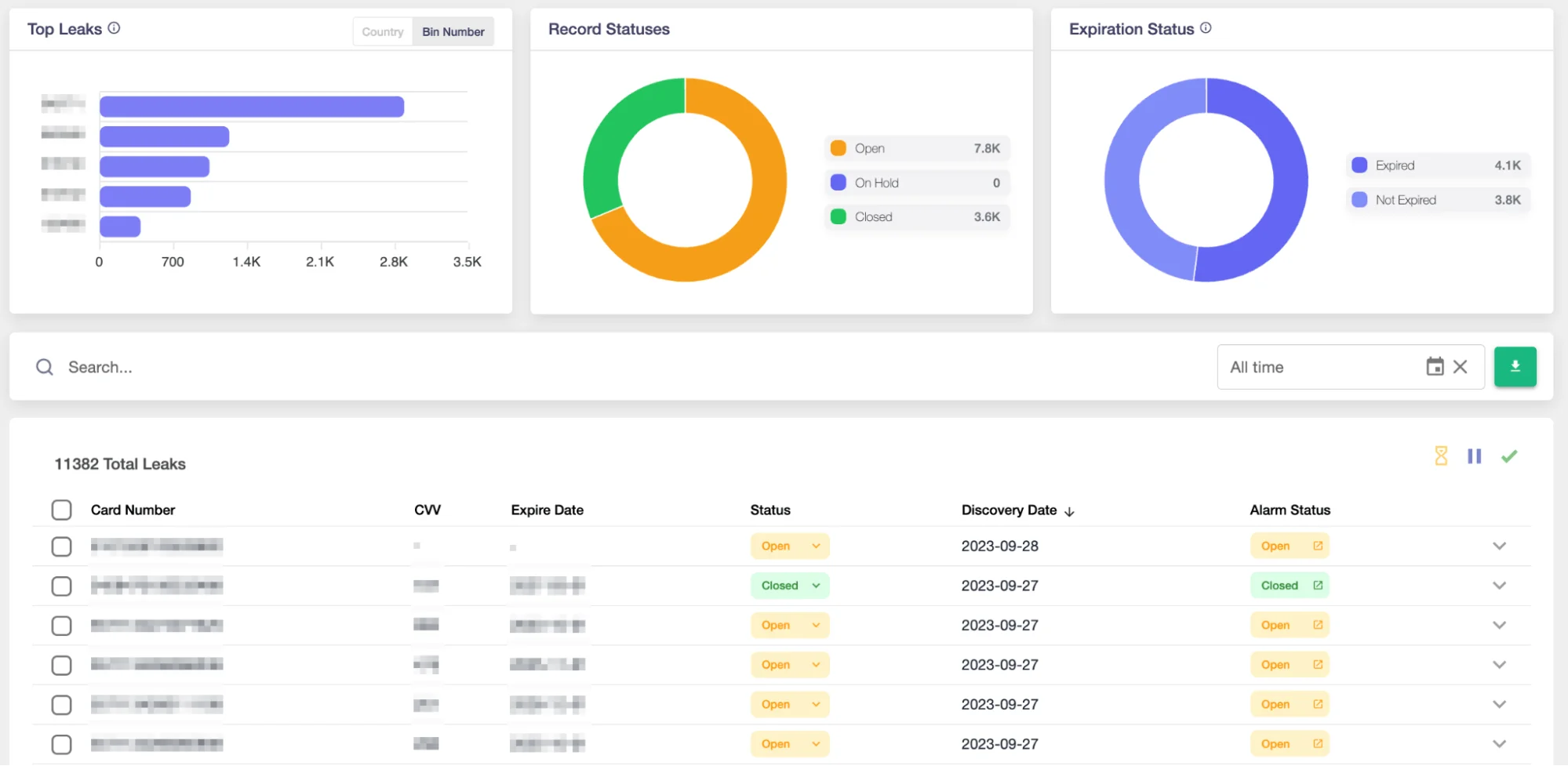

In a time when financial data breaches are increasingly common, SOCRadar’s Fraud Protection module acts as a reliable safeguard. Utilizing an AI-driven and automated platform, it continuously monitors the Dark Web for signs of compromised financial information. This includes tracking carding forums, black markets, and various communication channels where stolen credit card data may be traded.

SOCRadar Fraud Protection Module

The proactive monitoring approach is essential for identifying potential threats before they escalate, ensuring that both customer and employee financial data remain secure.

While doing this, SOCRadar’s Fraud Protection goes beyond traditional anomaly detection methods. But how?

How Does SOCRadar Fraud Protection Work?

One of the standout features of SOCRadar’s Fraud Protection is its detection system. SOCRadar scans more than 5000 sources to track threat actors. We track more than 4600 Telegram channels, 340 Discord servers and more than 200 Dark Web forums to find out about the latest moves of threat actors. SOCRadar’s scanning capabilities enable organizations to receive timely and essential notifications, ensuring no critical updates are missed.

This capability ensures that organizations consistently receive relevant and essential notifications without unnecessary noise or distractions.

SOCRadar scans more than 5,000 sources to track threat actors

The automation-powered alerting system within SOCRadar’s Fraud Protection module ensures that organizations are ready against evolving threats. SOCRadar detects leaks on Telegram channels or criminal forums swiftly, but notifying the related parties is also an essential aspect of the job. As soon as compromised credit card data is detected on Dark Web marketplaces, the system automatically notifies relevant stakeholders.

Finance is a fast-paced environment where every second counts. Immediate alerts can mean the difference between minor disruptions and significant financial catastrophes. This rapid alerting mechanism provides organizations with time to react to the leaks. They can notify their customers, block the cards or accounts automatically, and contact law enforcement if needed. This way, SOCRadar helps organizations stay ahead of cybercriminals and act before they try to use that data.

A threat actor trying to sell credit card information on a Dark Web forum monitored by SOCRadar

Another thing that makes the SOCRadar Fraud Detection module different is its continuous monitoring. In today’s dynamic threat landscape, it is essential to track threat actors constantly. They don’t stop their illicit activities, and SOCRadar keeps tracking them. Our Fraud Protection module leverages advanced technologies to continuously surveil our customers’ digital assets and sensitive information.

Conclusion

In conclusion, SOCRadar’s Fraud Protection module represents a comprehensive solution for organizations seeking to safeguard their financial data from cyber fraudsters.

With its AI-driven monitoring capabilities, real-time alerts, and proactive stance against payment fraud, it stands as an essential tool in any cybersecurity arsenal.

By adopting SOCRadar’s Fraud Protection module, businesses can not only protect themselves but also enhance their overall cybersecurity posture in an increasingly challenging environment.